Offshore Company Formation : A Comprehensive Overview for Entrepreneurs

Wiki Article

Approaches for Cost-Effective Offshore Company Formation

When considering offshore company development, the mission for cost-effectiveness comes to be a critical problem for businesses looking for to increase their procedures globally. offshore company formation. By discovering nuanced methods that blend legal conformity, economic optimization, and technological advancements, businesses can get started on a path in the direction of offshore company development that is both economically prudent and strategically audio.

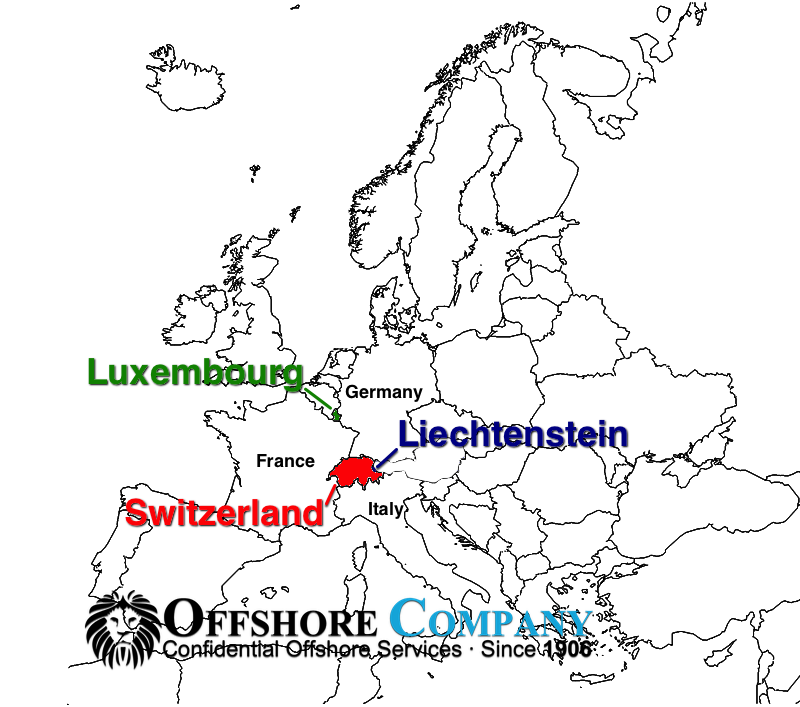

Choosing the Right Jurisdiction

When establishing an overseas business, selecting the suitable jurisdiction is a critical choice that can considerably impact the success and cost-effectiveness of the formation procedure. The territory selected will determine the governing framework within which the company runs, influencing tax, reporting requirements, privacy regulations, and general organization flexibility.When picking a jurisdiction for your overseas business, a number of factors have to be taken into consideration to guarantee the choice aligns with your critical goals. One crucial element is the tax obligation regimen of the territory, as it can have a significant influence on the company's earnings. In addition, the level of regulative conformity needed, the political and financial security of the jurisdiction, and the convenience of working must all be reviewed.

Furthermore, the reputation of the territory in the international service neighborhood is essential, as it can affect the perception of your business by customers, partners, and banks - offshore company formation. By carefully examining these elements and looking for professional guidance, you can select the best territory for your overseas firm that maximizes cost-effectiveness and supports your service purposes

Structuring Your Firm Effectively

To ensure optimum effectiveness in structuring your offshore company, thorough interest has to be provided to the organizational structure. The primary step is to define the company's possession structure plainly. This consists of determining the investors, supervisors, and policemans, as well as their responsibilities and functions. By developing a clear ownership framework, you can ensure smooth decision-making processes and clear lines of authority within the firm.Following, it is vital to take into consideration the tax ramifications of the selected framework. Various territories use varying tax obligation advantages and motivations for overseas firms. By very carefully assessing the tax obligation regulations and regulations of the selected jurisdiction, you can optimize your company's tax effectiveness and lessen unneeded costs.

Additionally, preserving appropriate paperwork and records is important for the reliable structuring of your overseas firm. By keeping precise and updated records of economic purchases, company choices, and compliance files, you can guarantee transparency and liability within the company. This not only facilitates smooth operations but additionally assists in demonstrating conformity with regulatory requirements.

Leveraging Modern Technology for Cost Savings

Efficient structuring of your offshore firm not only rests on precise focus to organizational frameworks yet additionally on leveraging modern technology for cost savings. In today's electronic age, innovation plays a critical duty in simplifying processes, lowering prices, and increasing performance. One way Go Here to utilize innovation for savings in overseas company formation is by utilizing cloud-based solutions for data storage space and partnership. Cloud innovation removes the requirement for pricey physical framework, reduces maintenance prices, and offers versatility for remote work. In addition, automation tools such as electronic trademark platforms, accounting software, and task monitoring systems can dramatically reduce hand-operated labor costs and enhance total efficiency. Welcoming on the internet interaction devices like video conferencing and messaging applications can also result in cost financial savings by minimizing the requirement for traveling expenditures. By incorporating technology tactically right into your offshore business formation process, you can achieve substantial savings while enhancing operational efficiency.Minimizing Tax Obligation Responsibilities

Utilizing strategic tax planning strategies can efficiently decrease the financial burden of tax resource responsibilities for overseas business. Among one of the most typical methods for lessening tax obligation responsibilities is via earnings moving. By distributing profits to entities in low-tax territories, overseas companies can legitimately reduce their overall tax obligation commitments. Additionally, capitalizing on tax incentives and exceptions supplied by the territory where the offshore firm is signed up can cause considerable savings.One more technique to lessening this article tax obligation obligations is by structuring the overseas business in a tax-efficient fashion - offshore company formation. This includes carefully creating the possession and operational framework to maximize tax benefits. As an example, setting up a holding firm in a jurisdiction with beneficial tax laws can assist lessen and consolidate revenues tax exposure.

Moreover, remaining upgraded on global tax guidelines and conformity needs is essential for minimizing tax obligation responsibilities. By guaranteeing stringent adherence to tax legislations and laws, overseas firms can stay clear of costly penalties and tax disputes. Seeking professional recommendations from tax obligation professionals or lawful professionals focused on worldwide tax obligation issues can also offer important insights right into efficient tax planning strategies.

Ensuring Conformity and Risk Reduction

Implementing durable compliance procedures is crucial for overseas business to reduce threats and preserve regulative adherence. Offshore jurisdictions often deal with increased scrutiny as a result of worries relating to money laundering, tax evasion, and various other economic crimes. To ensure conformity and alleviate risks, offshore companies need to carry out extensive due persistance on clients and company partners to avoid involvement in illicit tasks. In addition, carrying out Know Your Customer (KYC) and Anti-Money Laundering (AML) treatments can assist verify the authenticity of purchases and guard the business's reputation. Routine audits and reviews of financial documents are vital to identify any kind of abnormalities or non-compliance problems promptly.Moreover, staying abreast of changing guidelines and lawful needs is important for offshore companies to adapt their conformity techniques as necessary. Involving legal experts or compliance professionals can supply beneficial guidance on navigating complex governing landscapes and making sure adherence to international criteria. By focusing on conformity and danger reduction, overseas firms can enhance transparency, build depend on with stakeholders, and guard their operations from prospective legal consequences.

Final Thought

Utilizing critical tax obligation preparation strategies can properly reduce the financial problem of tax liabilities for offshore business. By dispersing revenues to entities in low-tax jurisdictions, offshore business can legitimately decrease their total tax obligation responsibilities. Additionally, taking benefit of tax motivations and exemptions used by the territory where the offshore business is registered can result in considerable financial savings.

By ensuring rigorous adherence to tax obligation regulations and laws, overseas business can avoid costly fines and tax obligation disagreements.In verdict, affordable offshore firm development needs cautious factor to consider of jurisdiction, efficient structuring, technology application, tax minimization, and conformity.

Report this wiki page